Fundrise Analysis 2024 | Invest in commercial real estate with just $10

Fundrise is one of the pioneers of online 50 largest real estate private equity investors in the world by total annual deployment — deployed more than $5.1 billion USD of capital annually in 2021. Founded in 2010, the platform has had some early success in this space, allowing everyday investors the chance to profit from real estate deals starting as low as $10 to $100,000.

But Fundrise is not the only real estate option on the market. And it's critical to understand how their fee structure works and what the process for redeeming shares looks like.

Our Fundrise review covers all the pros and cons, features, account types, and liquidity issues for this platform so you can decide if it's right for you.

- Low minimum investment – $10

- Diversified real estate portfolio

- Portfolio Transparency

Pros

- Low Minimum – The minimum investment to get started with Fundrise is $10.

- Low Fees – Fundrise charges just an asset management fee of 0.85% per year.

- No Accreditation – Unlike competing companies, Fundrise is open to any investor in the United States, regardless of income or net worth.

- Diversification – Unlike other private REITs, Fundrise eREITs have a pool of many properties that could smooth returns.

- Access to commercial real estate: Commercial real estate is often a high-cost investment, while Fundrise allows you to invest with little money.

- Passive Investing – Unlike owning your own commercial real estate, Fundrise investments are truly passive.

- Quarterly Redemptions and Distributions : Fundrise eREIT has adopted a quarterly redemption plan to provide regular liquidity; however, distributions are not guaranteed.

- Variety of investment objectives: Fundrise allows you to choose different portfolio objectives , such as supplemental income, balanced investments, and long-term growth.

Cons

- Investment Liquidity : Fundrise eREITs are not publicly traded. Once you make an investment, you are fairly committed to the investment for the term. You can sell shares before a five-year holding period, but you pay a 1% fee in many cases.

- Tax Consequences : Distributions are taxed as ordinary income, unlike the 15% tax rate on qualified dividends.

Start Investing In Real Estate With As Little As $10

Fundrise and commercial real estate investment

Investing in commercial real estate can be a great way to grow your savings, although it is not without risk.

The big risk ? Commercial real estate requires large amounts of startup capital to purchase a property. To properly diversify your portfolio, you must own multiple properties, multiple types of features (eg, apartment complexes, shopping malls, office space, etc.), and properties in multiple locations.

However, one avenue for the small investor who wants to invest in commercial real estate is through a REIT ( Real Estate Investment Trust ). Fortunately, for investors, there is an online platform that can make REIT investing simple.

It's called Fundrise , and we think it's one of the best real estate investment services on the market today . Let's take a closer look to find out how it works, how you can use it, and if it's for you.

- Low minimum investment – $10

- Diversified real estate portfolio

- Portfolio Transparency

How does Fundrise work?

When you sign up for Fundrise, you can invest in their initial portfolio with just $10 . Alternatively, Fundrise offers four different portfolio plans that have variable investment minimums and give you more control over the types of funds you invest in.

Whichever you choose, Fundrise invests your money in a variety of eREITs, and electronic funds consisting of private real estate assets located in the US. Fundrise will tailor your specific allocation based on your personal investment needs.

Although your results will vary depending on your plan, Fundrise pays investors in two ways :

- Quarterly dividend distributions

- Appreciation of the value of the asset at the end of the investment term of that asset. However, keep in mind that Fundrise portfolios are meant to be long-term in nature so it doesn't happen overnight. (Additionally, these returns cannot be guaranteed.)

Fundrise Features

Fundrise has changed significantly as a platform since its inception. These days, investors have much more control over the types of investment accounts they use and their overall portfolio strategy.

Some of the main features of Fundrise include :

- Self-Directed IRA (New): Now, you can invest in Fundrise with pre-tax dollars and use them to plan for retirement. (Note that self-directed IRAs can currently only be used for eREIT offerings.)

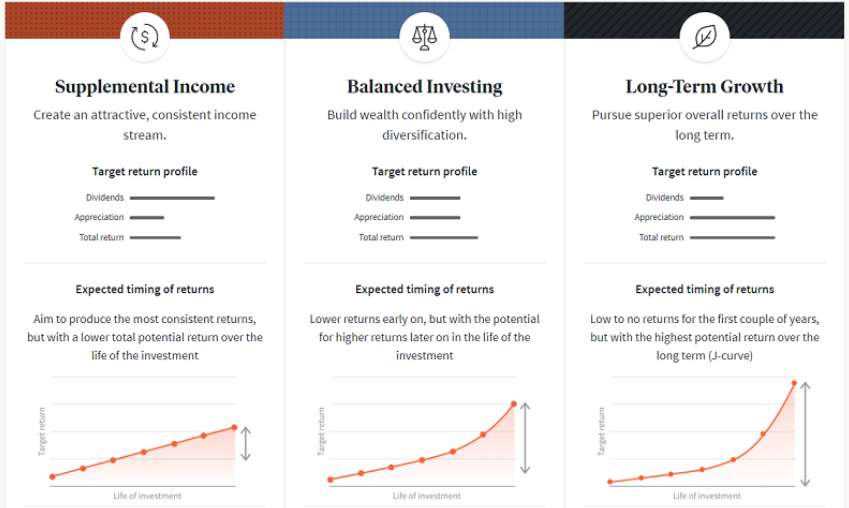

- Goal-Based Investing (New): Through the Fundrise 2.0 platform, invest in real estate based on your goals rather than investment types or location. Goals include supplemental income, balanced investment, and long-term growth.

- eREIT – A non-traded REIT that invests in multiple commercial real estate. Compared to traditional REITs, it cuts out the middleman by saving you commissions.

- eFund – A private fund that invests in multiple commercial real estate that, unlike Fundrise eREITs, focuses on growth rather than income.

- Standard & Plus Plans (New): Once you invest $10,000 or more, you can choose between the Standard or Plus plans. Both plans allow you to choose different investment objectives. Standard plans invest primarily in eREITS and commercial real estate funds. Conversely, Plus plans can invest in more specialized real estate strategies that the Fundrise team identifies on the market.

- Direct Investments – By investing in Fundrise eFunds, you can actually invest in specific real estate projects. For example, the Fundrise eFund focuses on debt and equity investments in homes and condominiums in the Los Angeles area.

- Fundrise iPO (New) – Fundrise is preparing to sell shares of the company itself through an “Internet Public Offering” (IPO). To be eligible for this investment, you must have at least $1,000 in your Fundrise account and have selected one of the advanced plans. You can invest up to 25% of your total account balance in this offer

What are the minimum requirements to invest in Fundrise?

Fundrise requires a minimum initial investment of just $10. This amount gives you the service's initial portfolio, a diversified mix of eREITS and eFunds with underlying real estate projects located throughout the United States. You receive income through quarterly dividends, as well as appreciation in the value of your shares.

With a $1,000 investment, you upgrade to the Basic Portfolio which opens Fundrise retirement accounts, investment goal planning and access to Fundrise iPO. And if you invest $5,000, you upgrade to the core portfolio, which lets you choose different investment plans to match your goals.

Different investment plans that Fundrise offers include :

- Supplemental Income: A steady income stream with a focus on dividends.

- Balanced Investing: A diversified portfolio made for greater wealth creation.

- Long-term growth: Designed for potentially superior returns over the long term.

If you're not sure which one is right for you, Fundrise offers a three-step quiz that can help you determine how you should invest.

You can also compare all the different Fundrise account levels and benefits to decide which plan is right for you :

| Initiator | Essential | Core | Advanced | Cousin | |

|---|---|---|---|---|---|

| minimum investment | $10 | $1,000 | $5,000 | $10,000 | $100,000 |

| standard plans | No | No | Yeah | Yeah | Yeah |

| Plus Plans | No | No | Yeah | Yeah | Yeah |

| Potential access to iPO | No | Yeah | Yeah | Yeah | Yeah |

| Automatic investment option | Yeah | Yeah | Yeah | Yeah | Yeah |

| Investor Objectives | Limited | Yeah | Yeah | Yeah | Yeah |

| Direct investment in open funds | No | No | Yeah | Yeah | Yeah |

But the fact that it only takes $10 to start investing in income-producing real estate is one of Fundrise's main strengths. And after you invest $5,000, you have more control over the types of investment plans you use.

👉 Fundrise Pro Advantages:

Fundrise Pro is built for investors who want to actively shape their alternative investment portfolio according to their beliefs about the market. While most of our investors prefer to spend as little time managing their portfolio as possible, we know there is a valuable audience who feels strongly about having full control over their investments. For our passive investors, the core experience will remain unchanged and fully supported as it always has.

Fundrise Pro has 4 key features included in the initial launch:

- Directly invest in specific funds: Make one-off investments into specific funds

- Build your own custom investment plan: Build your own portfolio with full allocation control across our various investments

- Expert-level data: Connect to unique tools including Basis™, our proprietary data warehouse, to make better wealth building decisions

- Exclusive content: Access Fundrise-curated insights from The Wall Street Journal

They are grandfathering 2 groups of Fundrise investors into Pro for free - existing investors with an account balance >= $5,000 or who have ever placed a direct investment. All other Fundrise investors will have the opportunity to opt into a 30 day free trial. Additionally, Pricing for Pro is $10/month or $99/year.

- Low minimum investment – $10

- Diversified real estate portfolio

- Portfolio Transparency

How has Fundrise performed?

Fundrise publishes historical performance reports each year, as well as quarterly reports. To date, it has had 21 positive quarters and zero negative quarters , with the worst quarter returning 1.15% and the best quarter returning 9.40% for investors.

Here's how Fundrise's performance compares to public REITs and the S&P 500 :

| fundraising | US Public REITs | S&P 500 | |

|---|---|---|---|

| 2022T 1 | 3.49% | -5.27% | -4.60% |

| 2021 | 22.99% | 39.88% | 28.71% |

| 2020 | 7.31% | -5.86% | 18.40% |

| 2019 | 9.16% | 28.07% | 31.49% |

| 2018 | 8.81% | -4.10% | -4.38% |

| 2017 | 10.63% | 9.27% | 21.83% |

As you can see, both the US public REITs and the S&P 500 have had quarters with higher returns. But they've also had worse quarters than Fundrise, so there's more volatility.

With that said, always remember that past performance is no guarantee of future performance.

Fundrise Rates and Prices

Fundrise charges an annual asset management fee of 0.85%, in addition to an advisory fee of 0.15%. These add up to 1.0% per year. You also don't pay transaction fees or sales commissions.

However, the company may charge other miscellaneous fees such as development or settlement fees which can add up to 2%. But for many long-term investors, Fundrise only charges 1% per year in fees.

How to redeem your Fundrise shares

When it comes to investing in real estate , liquidation is a crucial factor to consider. After all, real estate is less liquid than investing in stocks, ETFs, or even cryptocurrencies in most cases.

Fortunately, Fundrise has made some positive changes to make its shares more liquid . For eREITS and Fundrise eFunds, you can request a partial or full redemption of shares without paying penalties if you have held shares for 5 years or more. For actions less than 5 years old, you pay a penalty of 1%.

As for the Fundrise Real Estate Fund and Income Real Estate Fund, there is a quarterly settlement window in the form of quarterly repurchase offers that carry zero penalties.

Note: In extremely volatile market conditions and difficult times, Fundrise reserves the right to suspend its redemption program so that investors are unable to sell shares.

In general, Fundrise is a long-term investment game due to the 5-year requirement to avoid penalties. And just keep in mind that stocks aren't as liquid as other assets like stocks and ETFs.

Is Fundrise safe?

Very few investments can be considered truly "safe", that is, with a guaranteed return. However, less liquid real estate investments tend to provide better protection against downturns in the overall market than securities like stocks and mutual funds.

And Fundrise's eREIT and eFund portfolios are as secure as you can find in the real estate space.

Non-traded REITs and eREITs are registered investments, and while they are subject to the same SEC requirements that a publicly traded REIT must meet, they are not directly correlated with stock market fluctuations. Two downsides: There isn't the same liquidity since they aren't traded on the exchanges, and the front-end fees are higher than exchange-traded REITs.

eREITs vs. Non-traded REIT vs. publicly traded REIT

| Guy | EREIT | Non-Traded REITs | Publicly Traded REITs |

|---|---|---|---|

| they quote | No | No | Yeah |

| Secondary market | No | Usually not | Yeah |

| front-end fees | None | 0-15% | 0-7% + broker commission |

The minimum investment is just $10 for Fundrise eREITs, and you don't have to be an accredited investor to participate. Shares in eREITs are purchased exclusively online, and Fundrise members receive notifications when new assets are added to eREITs.

Is Fundrise legit?

Fundrise is a legitimate real estate investment platform and is registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940 .

It also has a low investment requirement and a strong track record. However, Fundrise correctly discloses that past performance is not a guarantee of future results or expected returns.

Alternatives to Fundrise

Fundrise is one of the best real estate investing platforms due to its minimum investment of $10. Few platforms offer such a beginner-friendly way to invest in real estate . And with its positive track record and variety of investment plans and funds, Fundrise has a lot going for it.

That being said, some Fundrise alternatives like RealtyMogul and Streitwise may be superior to Fundrise depending on your investment goals and initial investment amount.

| summaries | fundrise | RealtyMogul | streetwise |

| Classification | 9/10 | 9/10 | 7/10 |

| minimum investment | $10 | $5,000 | $5,000 |

| account fees | 1 year | 1-1.25%/year Asset Management Fee | 2% annual management fee |

| private REIT | |||

| join up | join up | Join – Streitwise |

RealtyMogul has similar fees to Fundrise. But one main difference is that many equity investments have target holding periods of three to five years, which is shorter than Fundrise. The investment minimum of $5,000 is much higher, but RealtyMogul focuses on investing in cash flow generating real estate and offers REITs and a 1031 exchange.

As for Streitwise , you pay 2% per year, which is higher than Fundrise. But Streitwise is focused on providing consistent dividend income. According to its website, Streitwise has returned 8% or more in annualized returns since 2017.

Overall, Fundrise is a comprehensive and beginner-friendly option for investing in real estate . And the fact that you can choose investment objectives with your Basic Plan is a bonus. But don't be afraid to look into some alternatives if you want more investment selection or dividend income.

In conclusion

Real estate as an asset class is a long-term investment . This includes REITs, whether publicly traded, non-traded, or eREITs. Opportunities for capital appreciation, portfolio diversification, and regular distributions are attractive; however, distributions are never guaranteed.

While not the same as investing in real estate directly, REITs are much more passive and allow you to invest in property outside of your geographic location. Fundrise can be a way to diversify into real estate without the huge amounts of capital or management headaches involved in doing it yourself.

Although I am a real estate investor, REITs have never appealed to me for a number of reasons, primarily due to the initial charge and ongoing fees. Fundrise takes the sting out of those investment fees with its 0.85% asset management fee.

And the fact that Fundrise only takes $10 to get started makes it a great way for investors to dive into real estate investing.

Fundrise FAQ

What is the big advantage of REITs?

By pooling the funds of many individual investors, the REIT is able to purchase a diversified mix of commercial properties, such as office buildings, shopping malls, hotels, and apartments, that the typical investor would not be able to purchase individually. One type of REIT, an exchange-traded REIT, is available through any broker; As its name implies, its shares are listed on the stock markets. However, exchange traded REITs have some disadvantages. For one, its performance is strongly correlated with the broader stock market.

How are eREITs different from other REITs?

Fundrise eREITs are more similar to non-traded REITs. The main difference is in the rates. When you invest in an eREIT, you don't go through a broker, but buy directly from Fundrise. That allows Fundrise to drastically reduce fees. There are no middlemen, so there are no upfront fees or commissions. And instead of paying a 7% to 15% upfront charge, Fundrise charges just a 1.0% annual asset management fee.

What are eFunds?

An eFund ( short for Electronic Fund ) invests in commercial real estate and is exclusive to Fundrise. It is similar in design to a professionally managed mutual fund, but like non-listed eREITs. Electronic funds are set up as partnerships and not corporations, so they are taxed differently – they save on double taxation, too, as eREITs Fundrise offers these electronic funds to investors without brokers or commissions. Unlike an eREIT that is typically used to earn income, Fundrise electronic funds are set up for growth.

Fundrise Features

| minimum investment | $10 |

| account fees | 1 year |

| time commitment | 0 months |

| accreditation required | |

| private REIT | |

| Types of offers | Debt, Equity, Preferred Capital, Direct Ownership |

| property types | Commercial, Residential, Single family, Foreign investors |

| Regions served | 50 states |

| Secondary market | |

| self-directed IRA | |

| 1031 exchange | |

| pre-screened | |

| pre-funded |

- Low minimum investment – $10

- Diversified real estate portfolio

- Portfolio Transparency

Very insightful information thank you for sharing

ReplyDeleteThis thorough analysis of Fundrise's investment landscape in 2024 and its alternative competitors provides invaluable insights for investors. The comprehensive examination sheds light on emerging trends, risks, and opportunities, empowering readers to make informed decisions in navigating the dynamic real estate investment market. A must-read for serious investors.

ReplyDeleteHaving info regarding longterm sustainable and relable investment platforms is very crucial in the modern age world. This reviewerpoints platform provides us with very unique and legit balanced info with whuch we can decide on our investment planning

ReplyDeleteWonderful. This is really great. Beautiful content to read

ReplyDeleteThank you for explaining about fundrise. It's a real helpful post as I didn't know much where should I invest and how. I am very lucky that I have found this post. Once again, thanks....

ReplyDelete