Goalry Review [2023]: The Most Powerful Virtual Financial Planning Mall Tracker

Goalry is a financial planning software that makes it simple to define and manage financial objectives.

Anyone who has attempted to save money understands how difficult it can be to manage financial objectives. You begin with the best of intentions, but it's all too easy to become distracted by unforeseen bills or a loss in income. Your financial ambitions may appear to be entangled in a large, intricate knot.

Goalry was intended to assist you in staying on track with your personal money objectives. Set wise financial goals and track your success over time with our user-friendly financial planning application. Best of all, it allows you to easily modify your strategy as your financial requirements and goals change.

What is Goalry?

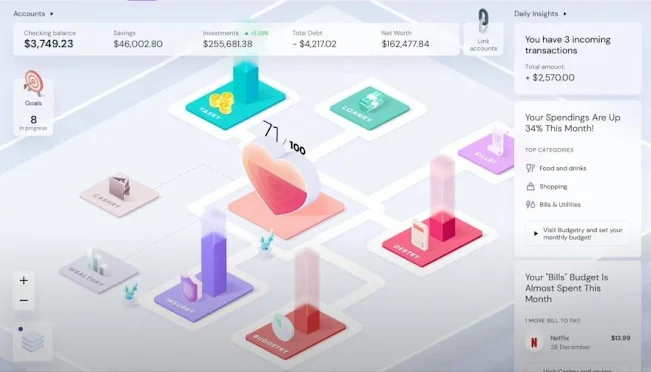

Goalry is a financial services startup that uses a simple and game-like interface to transform money management. With a collection of articles and videos, anybody can simply manage their personal money — including retirement, short-term objectives, and debt repayment — and increase their financial literacy.

Goalry, Inc., founded in 2016 by Ethan Taub, is based in Newport Beach, CA, and is fast acquiring a reputation as one of the finest financial planning platforms available today. The organization believes in delivering financial services to everyone in an easy-to-use manner.

How does Goalry work?

Finance stores

The Goalry Mall's whole third level is devoted to finance stores. On the floor, there are 11 separate businesses, each specialized in a specific form of financial aim. A savings store, an investment store, a debt reduction store, a wealth-building store, and other options are available.

Each shop is discussed in further depth below.

Finance education

The Money Mall's second level is dedicated to financial education. You may learn how to manage your money by reading 2,000 published articles and watching 400 videos. The program also provides 30-second responses to frequently asked topics and directs users to more in-depth answers.

Social community

The Money Mall community's first floor is dedicated to like-minded folks working toward financial objectives. To share your financial experience and stay accountable, you may connect with other users by publishing on the platform's private social media network.

Goalry's objectives tab displays all of your financial objectives from different stores on one page. View your savings goals for vacations and big-ticket things, or check how far you've progressed with paying off your credit cards. You can even establish new objectives directly from the objectives page without first visiting a specific retailer.

- Increase Property Value: To help you optimize the value of your home, you may get thorough assessments from top-rated real estate specialists.

- Improve your money management abilities: by tracking your spending. You'll also receive specific advice on how to improve your spending patterns and develop a budget that works for you.

- Make a savings: plan and track your success using Goalry's budgeting tools. Whether you're attempting to save for an emergency fund or a down payment on a house, Goalry can help you get there.

- Get Out of Debt: Get the skills and resources you need to begin dealing with your debt and working toward a debt-free life.

- Tax Management: With Goalry's tax tools, you can stay on top of your taxes and plan for future tax payments. Accounting and tax specialists can assist you, or you can manage your taxes yourself.

- Wealth Building: Use Goalry's wealth-building resources to learn about different investing techniques and pick the best one for you.

- Get Emergency Cash: Find the finest emergency cash choices for your financial requirements by contacting top lenders.

- Credit Management: is understanding how credit works and how your credit card usage and financial actions might affect your credit rating. Get access to credit monitoring tools and personalised credit-improvement recommendations.

- Insurance Comparison: Search a database of the finest insurance carriers to discover cheap coverage for anything from health and dental to life insurance. Compare several plans and obtain the coverage you want for yourself and your family.

- Loan Shopping: Use Goalry's loan shopping tool to become pre-qualified for a loan and compare offers from several lenders. Find the best rates and conditions for your needs, as well as guidance on how to find the best loan for you.

- Get Property Value: Determine the value of your house or investment property. Based on current sales data in your region, the tool will present you with an estimated worth.

How Goalry finance stores work

- Billry: Billry allows you to receive and pay your personal bills, such as utilities and credit cards, in one spot, allowing you to prioritise your bills. Billry also allows you to link to different bank accounts so that you can track all of your finances from one place.

- Budgetry: Create a budget in minutes and gain insight into your monthly spending habits. This application assists you in developing a spending plan that you can keep to and in making better financial decisions for the future.

- Cashry: With Cashry, all of your incoming and outgoing cash movements are automatically logged, ensuring that you always know how much money is accessible in your linked accounts.

- Creditry: Creditry allows you to check your credit score, monitor suspicious behaviour that might compromise your credit and identity, and receive personalised advise on how to improve your credit score.

- Debtry: Debtry allows you to build a debt reduction strategy, track your progress, and obtain financial expert ideas and assistance.

- Insurry: Whether you need vehicle insurance, life insurance, or health insurance, Insurry can help you compare policies and obtain the finest coverage at the most affordable pricing.

- Loanry: Loanry will link you with the top lenders and assist you in locating those with competitive rates and conditions that match your financial objectives.

- Taxry: Taxry offers a variety of tools to assist you with your taxes. These contain a variety of tax calculators as well as a list of tax preparation software and services that you may filter and arrange according to your requirements.

- Wealthry: Whether you need a tool to manage your money, compare investment accounts, or locate an adviser to assist you manage your portfolio, Wealthry has a wealth of options for you.

- Accury: Accury provides accurate property valuations, complete property reports, and advice on how to maximise your equity.

- Blockry: Using blockchain technology, Blockry allows you to manage your finances. You can organise, manage, and exchange digital assets safely, and you can even be informed of fraudulent activities.

Who is Goalry best suited for?

Anyone who wishes to organise and keep on track with their financial objectives may find Goalry's solutions useful. The service employs a straightforward goal-setting process that enables you to visualise your progress and keep on track with the big-picture goals that are most important to you.

The Debtry app, for example, may assist you in consolidating your debt into a single straightforward payment. If you want to start a new business or save for a house, the Wealthry app can provide you with the information and tools you need to make wise financial decisions.

Goalry may be a little frightening for someone who is just starting with financial organisation, despite its appealing and comfortable layout. For some folks, standalone budgeting applications and software may be a better solution.

How to get started with Goalry

Goalry pricing

There are three membership plans available: basic, premium, and annual. Until you create a bank account, you can only utilise the free Basic plan. This begins your 30-day free trial of Premium, after which you will have to pay.

Bottom line

Goalry is designed to alleviate the strain and worry of managing your financial objectives in various places. Using the platform's resources might help you attain your financial objectives more effortlessly.

Having a system in place to measure your financial success will assist you in remaining motivated, focused, and on track. Sign up for Goalry or browse these budgeting apps to find a solution that will help you reach your financial goals now.

.jpg)

Post your comment