Quick Summary: Linqto is designed to simplify the process for affluent investors to purchase shares in private companies that have the potential to become future billion-dollar companies. The platform allows individuals to invest as little as $10,000, but to qualify for an account, one must be a certified investor, which means most people are not eligible.

How did we arrive at this conclusion?

Advantages

- The lowest minimum investment compared to other investment firms

- No additional charges or undisclosed expenses

- Detailed information available on the companies listed, including their worth, risks, and financial statements

Disadvantages

- The requirement to be a certified investor to open an account

- Restrictions on the number of companies one can invest in

What Is Linqto?

Linqto operates from San Francisco and serves as an investment platform that enables qualified investors to purchase shares in private businesses for as little as $10,000. Through this platform, investors can search, study, assess, and put their money into businesses they think will increase in worth. As of March 2022, Linqto featured 26 private businesses on its platform, covering a variety of sectors including fintech startups, software, e-commerce, healthcare, and sustainable materials companies.

Definition of an Accredited Investor- Annual income that surpasses $200,000 (or $300,000 with a spouse or equivalent partner) in the last two years, and a reasonable expectation of the same in the current year

- Net worth exceeding $1 million, either on your own or with a spouse or equivalent partner, excluding the value of your main residence

- A valid Series 7, 65, or 82 license

Who Should Consider Using Linqto?

|

Linqto aims to simplify the search for the perfect investment opportunity. The journey starts by navigating to the "Invest" section, where a list of companies is displayed. Here, you have the option to narrow down your search by industry (for example, E-commerce, Foodtech, Marketing Software, etc.) or arrange by company name, valuation, or date of establishment. Following this, you can click on the pages of individual companies to access their latest news and details, including Linqto Investment Summaries. These summaries offer comprehensive insights into the company's valuation, risks, financial health, and an overview of its business operations.

Once you've chosen a company, you'll adjust the slider to determine the amount of your investment, and then press the "Place Order" button to start your investment journey. Linqto's dedicated team of financial experts will assist you throughout the investment process to finalize your transaction. You'll also receive wire instructions and a confirmation email once your investment is successfully processed. New investors have a 10-day window to fund their investments, whereas returning investors have a 5-day window.

Ease of Use

Government rules mandate that only affluent investors with accreditation are eligible to participate in services such as Linqto. Individuals who fail to satisfy the criteria are barred from investing with the firm, rendering it unattainable for the majority.

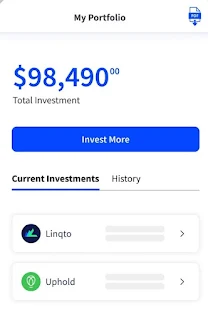

Account Minimum Requirements

Given that certain investment companies demand an investment of $100,000 or higher, Linqto offers a more budget-friendly alternative. Every investment through Linqto starts at just $10,000, allowing you to spread your money among various businesses.

Transaction Fees

Linqto does not charge any fees for its investment management services – there are no management fees, brokerage fees, carried interest, or any other additional charges. This feature makes it an attractive choice for investors who wish to keep their returns as high as possible by avoiding unnecessary fees.

Variety of Investments Offered

At Linqto, your sole investment choice is in private businesses. Compared to investment companies that allow you to choose from stocks, bonds, mutual funds, and various other investment options, Linqto lacks a significant range of diversification. Nonetheless, there is still a good selection of company types available for investment.

Comparison to Competitors Platform | Best For |

| Linqto | Accredited investors who want comprehensive information about the companies they invest in. |

| Bloomio | Investors worldwide in search of a wide variety of companies across numerous sectors. |

| SeedInvest | Investors new to the game looking for a minimal investment amount to invest in startups. |

Yes, according to U.S. regulations, all investors on Linqto must be accredited.

Upon the exit of an underlying company from the private market to the public, Linqto will obtain your brokerage account details. If you don't have a brokerage account, you can open one with either an online or traditional broker. Linqto will then transfer your newly public, registered shares of stock into your brokerage account.

You can verify your identity through Linqto’s website or mobile app. After creating your account, you will be guided to a page where you can scan either your passport or driver’s license. After scanning, you will be prompted to take a selfie to complete the verification process.

Post your comment